Free Quote

- Home

- Free Quote

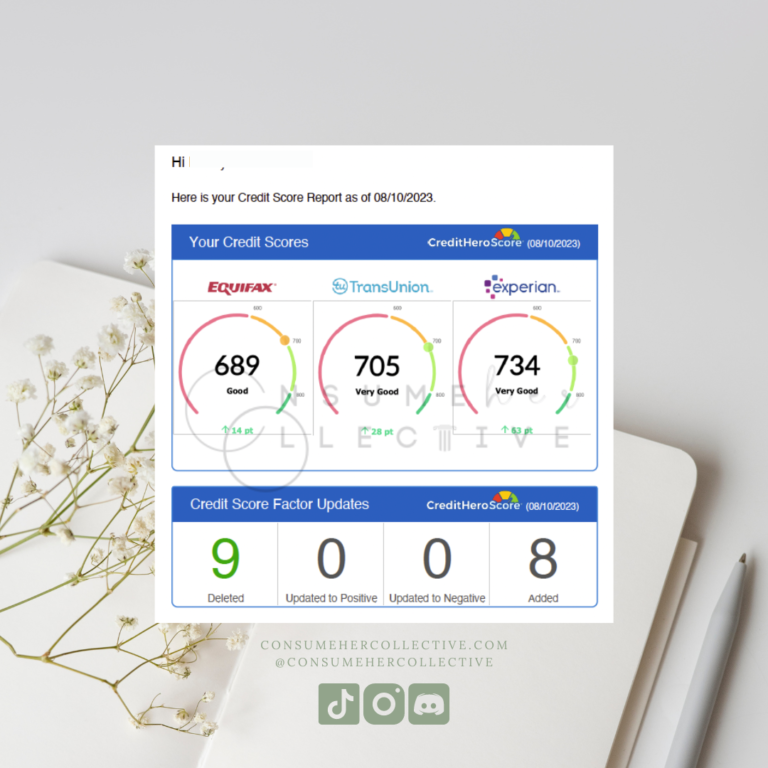

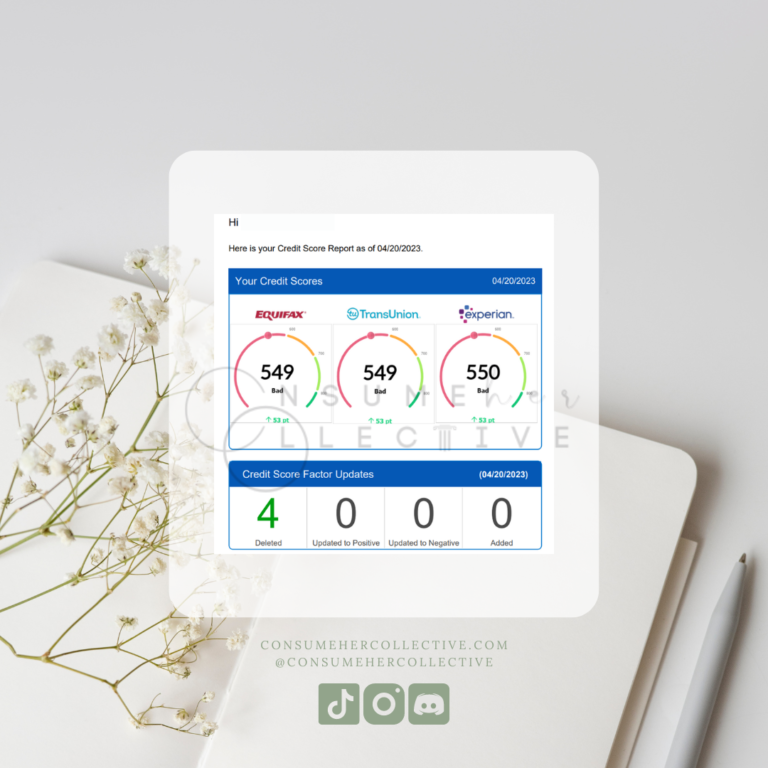

Client Results:

Step 1:

Create an account with IdentityIQ

To perform an audit, we require all clients to have/create an account for their participation in our requesting a quote/audit.

As a client, this service will be required as the credit monitoring allows us to obtain monthly updates; this helps us identify the removal of items and understand which ones still require attention.

*We understand that you may already have an account with another provider, however, our system is only compatible with the one linked. Kindly use the link below to create an account BEFORE completing the form as the login info is required when submitting the form.

Using my link also allows us an opportunity to resolve any reporting issues for you so we won’t experience any delays with your disputes! Let us handle it all so we can stay on track!

Step 2:

Complete Quick Form Below!

It is pertinent that the information provided below is correct and accurate as it will be used to perform your audit. Providing incorrect information will not warrant a response.

Once you click the “Submit” button, sit back and chillax – we’ll send your full audit within 24-72 business hours 🙂

Client Perks:

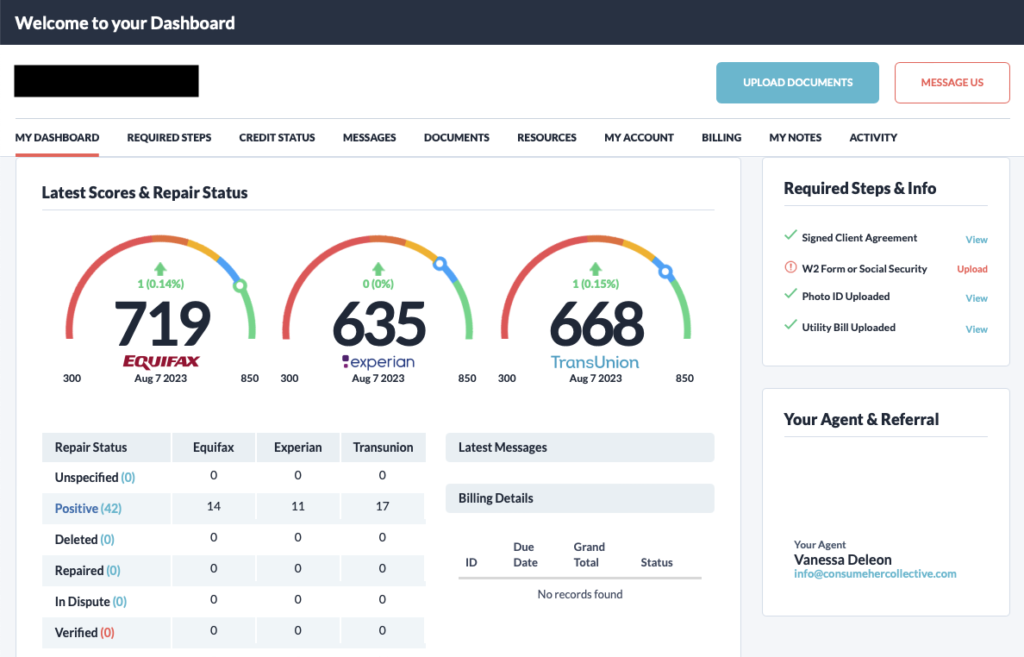

Client Portal

Personalized Client Portal: At ConsumeHER Collective, we believe that transparency and empowerment are key to successful credit repair. That’s why we’ve invested in a cutting-edge client portal, putting you in control of your credit improvement journey. As a client, you can gain access to an exclusive client portal that empowers you to track the progress of your credit repair journey in real-time. Our user-friendly portal provides you with a comprehensive view of your credit report updates, dispute statuses, and the positive changes we’re making to enhance your credit profile.

Through our secure and intuitive client portal, you’ll be able to:

Monitor Progress: Keep tabs on the status of your credit disputes, settlements, and other actions we’re taking to improve your credit score. You can see when we send your letters!

Track Updates & Get Monthly Progress Reports: Stay informed about any changes or updates to your credit reports, ensuring you’re always up-to-date on your credit standing.

View Results: Witness the positive impact of our efforts as negative items are removed and your credit score begins to rise.

Access Resources: Find valuable educational resources, tips, and tools to further your understanding of credit management and financial wellness.

Communicate Effortlessly: Communicate with our team, ask questions, and receive updates directly through the portal, streamlining the client-business interaction.

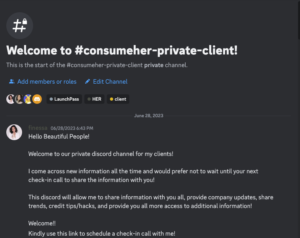

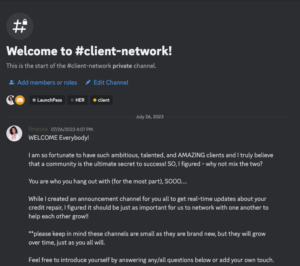

Exclusive Client Community on Discord

Private Discord Channel for Client Updates & An Opportunity to Network: Elevate your credit repair experience with exclusive access to our private Discord channel, designed to keep you connected, informed, and engaged. This unique offering goes beyond traditional communication methods, providing you with a dynamic platform for staying up-to-date and connecting with like-minded individuals on their own credit improvement journeys.

In our private Discord channel, you can:

Receive Real-Time Updates: Get instant notifications on the latest developments in your credit repair process, ensuring you’re always in the loop.

Engage with Experts: Interact with our credit repair experts, ask questions, and gain insights into the strategies we’re implementing to enhance your credit profile.

Connect with Peers: Network with fellow clients who are also committed to achieving better credit. Share experiences, tips, and success stories to inspire and motivate each other.

Access Exclusive Content: Enjoy access to exclusive content, such as live Q&A sessions, educational webinars, and informative posts that empower you to take control of your financial future.

Stay Empowered: Our Discord channel serves as a supportive community where you can find encouragement, advice, and guidance from both our team and your peers.

At ConsumeHER Collective, we recognize that collaboration and support are key components of your credit repair journey. Our private Discord channel not only keeps you informed but also fosters an environment of learning and growth as you work towards achieving your credit goals. Join us in this interactive space and embark on a transformative journey towards financial success.

Services include:

Freezing Secondary Credit Reporting Agency Accounts:

Freezing the “secondaries” disrupts the CRAs from sharing information with each other and aids in the deletion process.

Credit Report Analysis:

Thoroughly reviewing clients’ credit reports to identify errors, inaccuracies, and negative items affecting their credit scores.

Dispute Resolution:

Initiating disputes with credit reporting agencies, creditors, and collection agencies to challenge and remove inaccurate or outdated information from clients’ credit reports.

Customized Action Plan:

Developing personalized strategies to address specific credit issues and improve clients’ credit scores over time.

Debt Validation:

Validating the legitimacy of debt information with creditors and collection agencies to ensure accuracy and proper reporting.

Credit Score Monitoring:

Continuous monitoring of clients’ credit scores and reports to track progress and identify any new negative entries.

Debt Management Guidance:

Providing clients with resources to manage their debt effectively and make informed financial decisions.*NOT TO BE INTERPRETED AS FINANCIAL ADVICE.

Credit Education:

Offering resources and guidance to educate clients about credit management, factors affecting credit scores, and best practices for maintaining healthy credit.

Identity Theft Assistance:

Assisting clients in resolving issues related to identity theft, including fraudulent accounts and incorrect personal information.

Budgeting and Money Management:

Offering budgeting tools, resources, and advice to help clients better manage their finances and improve their creditworthiness.

Credit-Building Strategies:

Advising clients on ways to responsibly build positive credit history, such as opening new credit accounts and using them wisely.

Regular Progress Updates:

Keeping clients informed about the progress of their credit repair journey and providing updates on changes to their credit reports – updates sent every 30 days.

Legal Compliance:

Ensuring that all credit repair practices adhere to relevant laws and regulations.

Client Support:

Offering responsive customer support to address clients’ inquiries, concerns, and updates throughout the journey.

Interested In Seeing What The Process Looks Like?

Feel free to watch this video explaining what the process looks like! i.e. timelines, pricing, processes, what’s included, etc!